Protesting Your Property Taxes in Texas

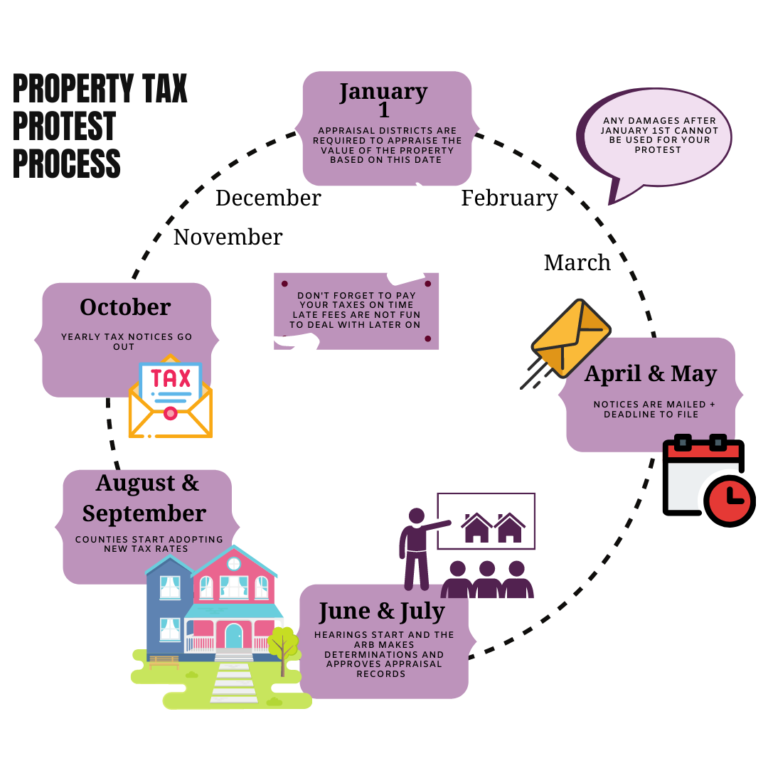

Every year around April and May you receive the new Appraised Value of your home. This is sent by your County’s Appraisal District; the value is what you will be taxed on for the following year and will be based on the recent sales in the area.

What many people don’t know is that you as a Homeowner have a right to lower your Property Taxes. If you do not agree with the value that the Appraisal District has assigned to your home, you have the right to protest it.

To start you do have to file a Protest with your corresponding Appraisal District before the Deadline (the deadline is typically attached to the letter containing the new value). Once they receive the protest form, they will assign you a hearing date.

The entire process can be pretty demanding. From getting evidence such as photos of physical damage the property may have, to gathering receipts and invoices of any expenses you may have incurred for the property during the previous year, to comparing your home to the value of that of your neighbors. This is then followed with a hearing where you present your all your evidence and make your case as to why your Property Value should be lower.

You can always do this process yourself, or you have the option to hire an agent to represent your property on your behalf.

Latest Videos

Visit our YouTube Cadilac Law for more videos on Property Tax Protest.

Property Tax Protests 2021

Attorney Cadilac tells you how to #protest your #propertyvalue in this hour-long seminar. By the end of the seminar, you should know what type of #evidence to use and what a #homestead #exemption does for you. We even discuss #trusts briefly!

Property Tax Protest Introduction

Please like, subscribe, and click the notification bell to be updated on my new videos to come. Don’t forget to share with the people you know that need to hear it.

Join Mailing List

We have the experience to represent your interests in protesting your property’s value and doing what it takes to lower it. We also hold seminars to teach you more about the Property Tax Process if you choose to represent yourself! Sign up for our Seminars Here.